Keywords: China, manufacturing cost, transport cost, Credit Suisse, jobs, per capita income

There is growing concern among U.S. and European companies that higher China manufacturing and transport cost, coupled with an inability to push through price increases due to the weak economy, will pressure profit margins in 2011. This according to a Credit Suisse report citing their survey of mostly private consumer, industrial and technology companies that source products from China. An article in Reuters provides details – highlights below.

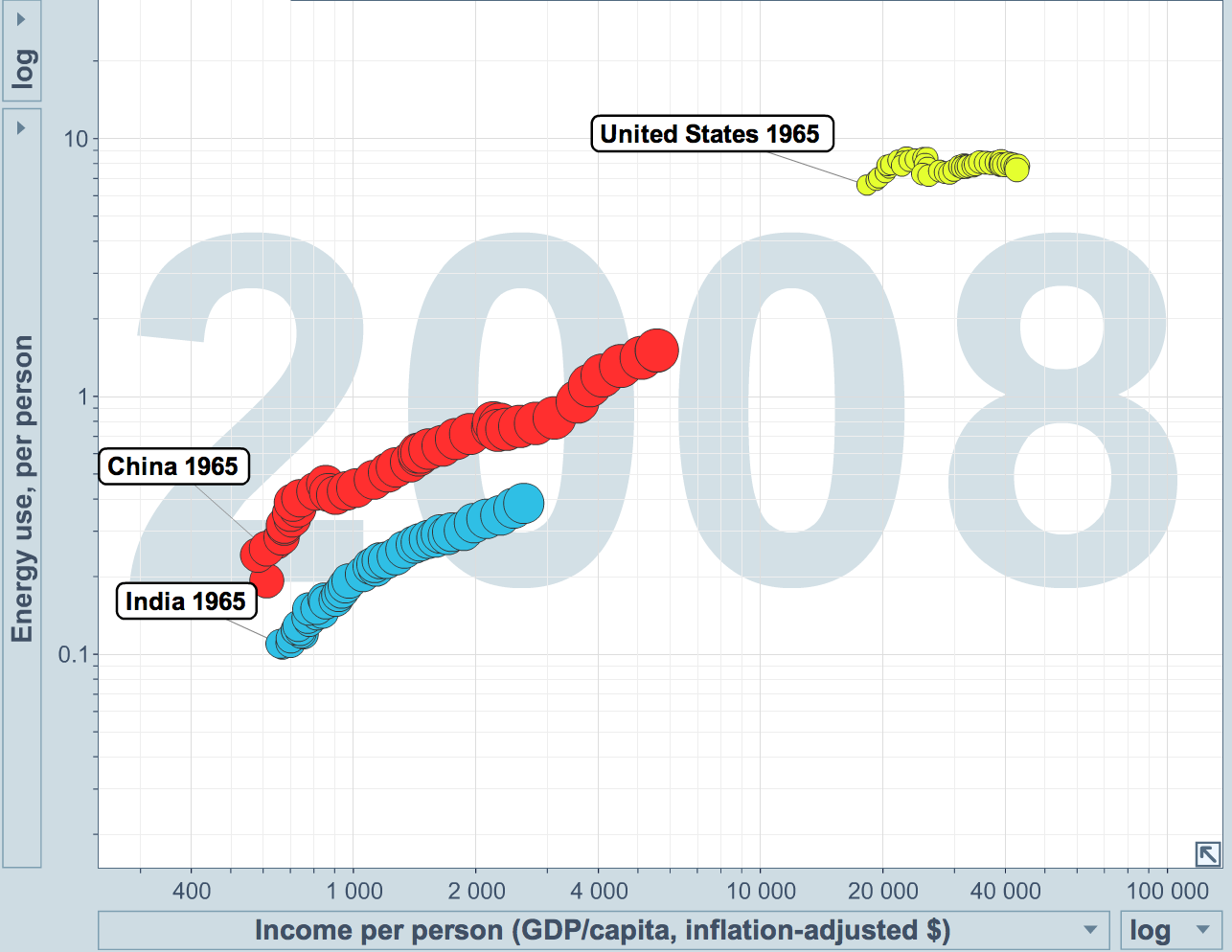

This should not come as a surprise to anyone that is observing the trends in China around per capita income and consumption. China is becoming America – fast. Before we know it, we will be bringing jobs back here to the US. You might think that jobs would migrate to India or Southeast Asia next, and there will be some of that, but the inflation occurring in China will happen to those countries too as they move up the income and consumption curve. Using GapMinder’s Trendalyzer with energy consumption data from BP’s Statistical Review of World Energy 2010 and income data from the IMF, we can see some powerful trends unfolding (N.B. data presented for 1965 through 2008, 1 year steps, circle area proportional to population size, energy use in tonnes of oil equivalent):

And with increasing resource scarcity (water, energy, food) and climate change, those regions will likely be challenged by social tensions or state instability (see National Intelligence Assessment on the National Security Implications of Global Climate Change to 2030 by US Director of National Intelligence in Recommended Reading). With all this to consider, we encourage companies to take the long view as they evolve their manufacturing strategy.

Highlights from China costs may surprise investors–Credit Suisse

- Credit Suisse, which said it sees the risk of very limited pricing power for consumer companies next year amid tepid economic growth, found 40 percent of respondents are “very worried” or “extremely worried” about wage pressure in China; 29 percent are very or extremely worried about transport costs; and 18 percent are so about the rising yuan currency.

- About 40 percent of executives said their costs on Chinese-sourced goods are up at least 6 percent from a year ago, with nearly a third reporting a double-digit increase. The survey polled 28 firms with annual sales of at least $500 million that rely on China for a portion of their goods sold.

- Nearly half of respondents said it is “not easy at all” to relocate sourcing from China and two-thirds say they could increase prices somewhat, but would likely lose profit margin.

- China’s explosive economic growth has pushed up manufacturing wages nearly fourfold over the past decade. The average worker earns about $3,900 a year, up from about $1,900 in 2005 and just over $1,000 a year in 2000. Wages are expected to rise further, reflecting emerging labor shortages.

- The pace of wage increases, currently around 13 percent a year, could accelerate, Rochon said. With U.S. wages flat or down, the difference in costs is narrowing, especially as transport costs — and times — go up.

- Containership fleets, eager to cut capacity, save fuel and raise prices, have slowed ships crossing the Pacific by about 50 percent. More inventory is sitting on the ocean.

- Factoring in currency, wages and transport, the hit to earnings could be substantial for some companies, Rochon said.

- Credit Suisse posits a worst-case scenario in which costs rise 20 percent with no ability to pass on higher prices. Under that scenario, 2011 earnings per share (EPS) would be reduced by about 60 percent at Maidenform Brands Inc and by some 70 percent at Jones Apparel Group Inc.

- Giant retailers like Target Corp and Macy’s Inc would see about a 40-percent hit to 2011 earnings. On the other hand, a stronger currency and rising living standards in China could benefit companies that sell to Chinese consumers, such as Yum Brands Inc and McDonald’s Corp, the report said.

- The biggest risks are not to makers of high-margin, easy-to-ship products like Apple Inc’s iPads, or to labor-intensive, high-volume manufacturers like clothing companies, which can move operations. Rather it is companies in the middle that are the most exposed, such as low-priced retailer Dollar Tree Inc with about 40 percent of goods sourced from China, according to Credit Suisse.

- Current Wall Street estimates call for Dollar Tree to earn $3.35 per share in fiscal 2011, according to Thomson Reuters I/B/E/S. That would fall to $2.24 if costs rose 20 percent with some pricing power, and EPS would be only $1.67 without pricing power, the report estimates.

- Some companies have already responded. General Electric Co, for example, has moved production of its hot water heaters to Kentucky from China, partly as a reaction to cost.

- Large industrial companies like GE, Cummins Inc and Emerson Electric Co would see 2011 EPS reduced by 10 percent or more under the adverse scenario.

- Electrical machinery and equipment were the top U.S. imports from China at $73 billion, though the report notes many industrial companies manufacture in China for the local market and are able to move production elsewhere.