Keywords: Bill Gates, climate change, energy, renewable energy, TED, zero carbon emmissions

Many newspapers and blogs are reporting on the Technology Review interview with Bill Gates (highlights below). Though that interview contains some good information, Gates’ presentation at TED was the stake in the ground that set the stage for this Technology Review interview. At TED, Gates called for reducing carbon emissions to zero. The presentation is worth watching. Considering that Gates is one of the most public faces of big business, his statements at TED are noteworthy:

- climate change is real

- climate change is the most important challenge on the planet

- carbon emissions need to be reduce to zero as soon as possible, his goal is by 2050

- increased investment in energy R&D is essential, and can be done at reasonable levels

- zero carbon energy production makes business sense

Highlights from Technology Review interview with Bill Gates

On US Investment in Energy

TR: You are a member of the American Energy Innovation Council, which calls for a national energy policy that would increase U.S. investment in energy research every year from $5 billion to $16 billion. I was stunned that the U.S. government invests so little.

BG: I was stunned myself. The National Institutes of Health invest a bit more than $30 billion.

On Carbon Tax

It’s ideal to have a carbon tax, not just a price on carbon, which is this fuzzy word that includes cap-and-trade. You’re using the tax to create a mode shift to a different form of energy generation. And then you just take all the carbon-emitting plants, you look at their lifetime, and you say on a certain date this one has to be shut down and when a new one is put in place, it has to be low-CO2-emitting.

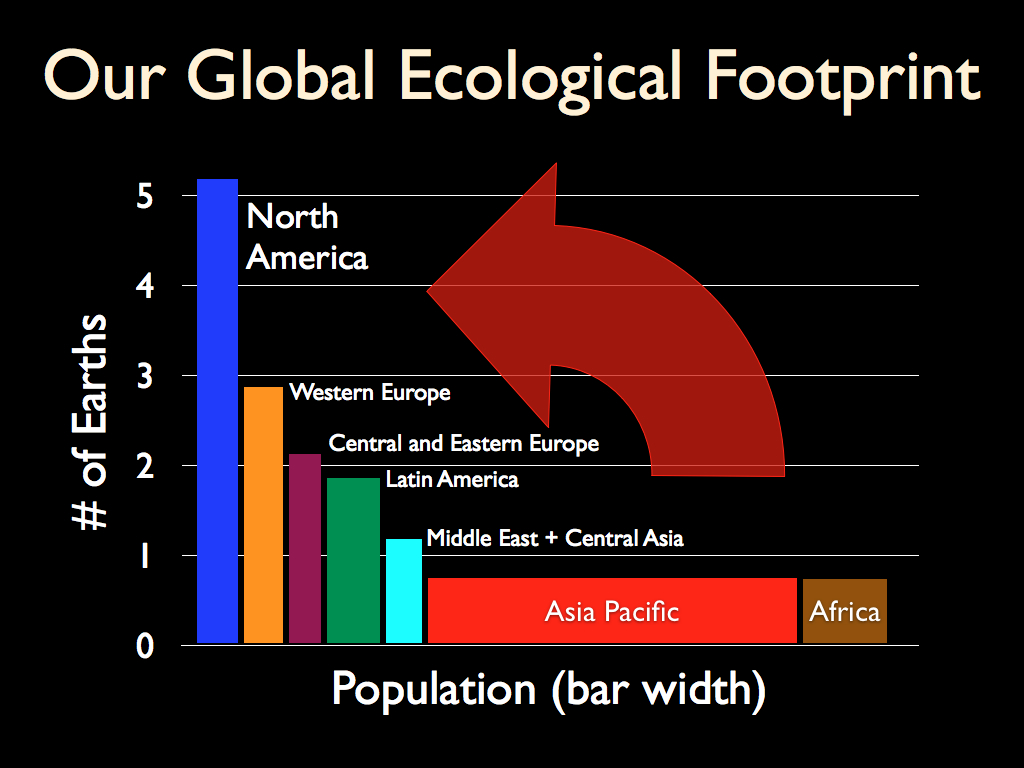

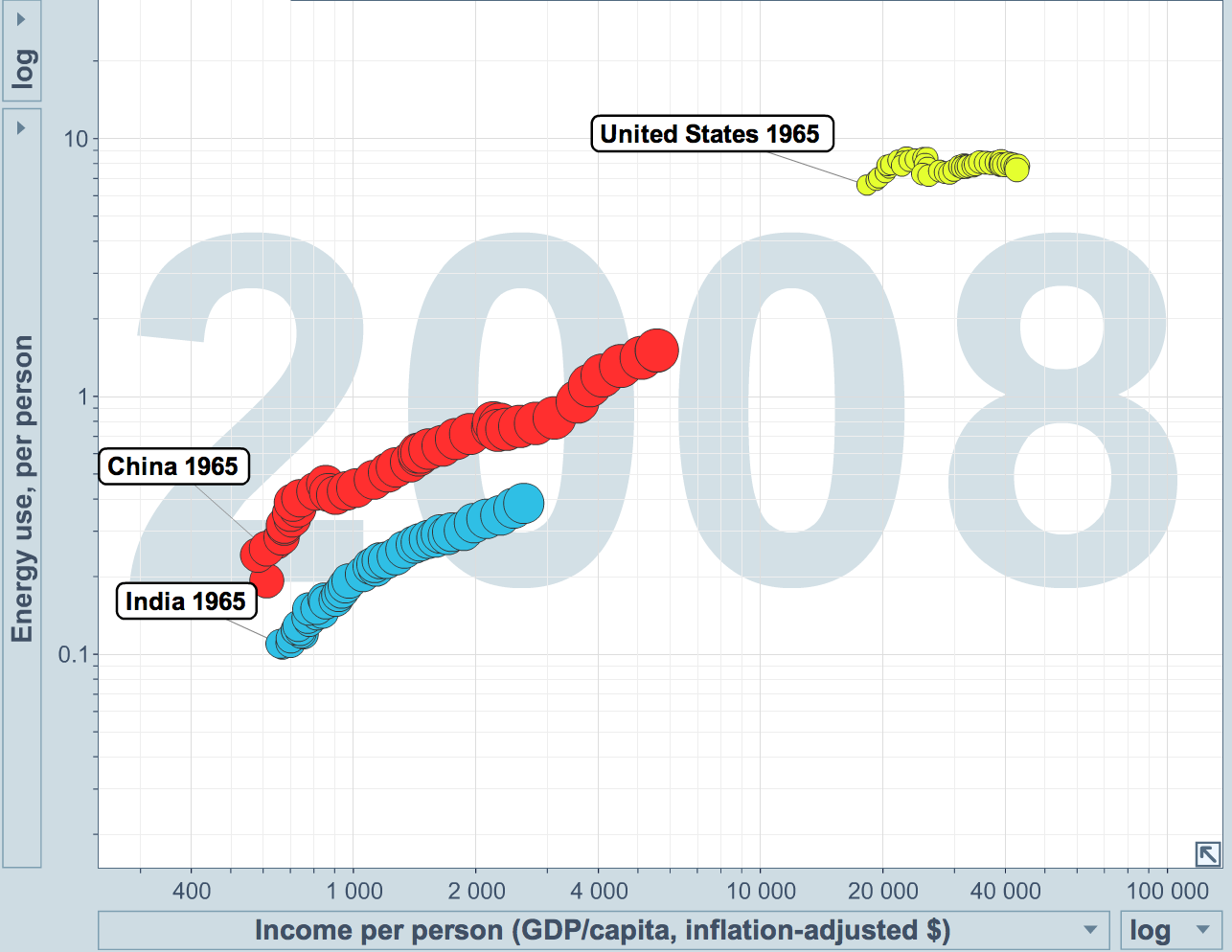

That’s a regulatory approach, and it’s very clear. Innovators are designing things for the power-plant buyers 10 years from now, who are looking at the regulatory and tax environment for the next 40 years. If you said to a utility company executive, which is more likely to stay in place: a cap-and-trade thing, whose price will vary all over the map, that will have some international things that will be shown to be a waste of money? Or a tax and a regulatory framework for plant replacement over the next 50 years? We should have a carbon tax. What we owe the developing world is this: we’re willing to pay high prices for energy plants above coal and drive prices down the curve so by the time they need to buy them, they don’t have to pay the high price.

Which is more likely: a carbon tax with all sorts of markets and options and uncertainties about prices, and traders in the middle, and confusion about who initially gets the most advantage? Or a regulatory thing and a 2 percent tax to fund the R&D so that utilities know they can buy a plant that’s emitting hardly any CO2? Raising energy prices by 2 percent and sending it to R&D activities seems easier in a weak economy than raising them 20 percent. Now, 0 percent is the easiest option of them all, but unfortunately, that doesn’t get us the solution to this problem.

The CO2 problem is simple. Any amount you emit causes warming, because there’s about a 20 percent fraction that stays for over 10,000 years. So the problem is to get essentially to zero CO2 emissions. And that’s a very hard problem, because you have sources like agriculture, rice, cows, and small sources out with the poorest people. So you better get the big sources: you better get rich-world transportation, rich-world electricity, and so on to get anywhere near your goal. If X or Y or Z gets you a 20 percent reduction in CO2, then you’ve just got the planet, what, another three years? Congratulations! I mean, is that what we have in mind: to delay Armageddon for three years? Is that really it?

The U.S. uses, per person, over twice as much energy as most other rich countries. And so it’s easy to say we should cut energy use through better buildings and higher MPG and all sorts of things. But even in the most optimistic case, if the U.S. is cutting its energy intensity by a factor of two, to get to European or Japanese levels, the amount of increased energy needed by poor people during that time frame will mean that there’s never going to be a year where the world uses less energy. The only hope is less CO2 per unit of energy. And no: there is no existing technology that at anywhere near economic levels gives us electricity with zero CO2.

On Renewable Energy

Almost everything called renewable energy is intermittent. I have another term for it: “energy farming.” In fact, you need not just a storage miracle, you need a transmission miracle, because intermittent sources are not available in an efficient form in all locations. Now, energy factories, which are hydrocarbon and nuclear energy–those things are nice. You can put a roof on them if you get bad weather. But energy farming? Good luck to you! Unfortunately, conventional energy factories emit CO2 and that is a very tough problem to solve, and there’s a huge disincentive to do research on it.

I think Gates approach to energy storage and transmission is too brute force. We are early into innovating alternative energy, and already there are some good innovations showing up that provide solutions to wind and sun intermittence. See Using Water Heaters to Store Excess Wind Energy for a good example of innovations that use existing infrastructure for storage and transmission.