With Bush-era tax cuts about to expire, a lot of attention is being focused on extending tax cuts for the rich – suggesting it will help the economy grow. Frank Rich, in his weekly op-ed piece at the New York Times, deconstructs that idea and examines the issue through the lens of income inequality.

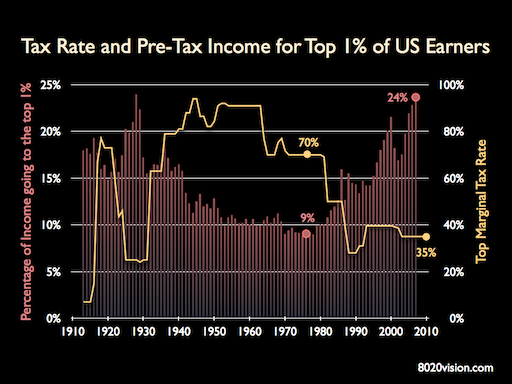

The top 1 percent of American earners now have tax rates half what they were in the 1970s. And they took in 23.5 percent of the nation’s pre-tax income in 2007 — up from less than 9 percent in 1976. During the boom years of 2002 to 2007, that top 1 percent’s pre-tax income increased an extraordinary 10 percent every year. In that same period, the average inflation-adjusted hourly wage went down more than 7 percent and the poverty rate rose.

The rich have been getting richer as their tax rate has steadily eased. And they are taking the added wealth and using it to influence public policy, to the detriment of the middle class.

“How can hedge-fund managers who are pulling down billions sometimes pay a lower tax rate than do their secretaries?” ask the political scientists Jacob S. Hacker (of Yale) and Paul Pierson (University of California, Berkeley) in their deservedly lauded new book, Winner-Take-All Politics

…Inequality is instead the result of specific policies, including tax policies, championed by Washington Democrats and Republicans alike as they conducted a bidding war for high-rolling donors in election after election.

And as Frank Rich points out, the American Dream is not well. Rather than middle class wage earners moving up the ladder, there are less and less people becoming wealthy, and more and more of the wealthy simply becoming wealthier.

Nor are the superrich helping to further the traditional American business culture that inspires and encourages those with big ideas and drive to believe they can climb to the top. Robert Frank, the writer who chronicled the superrich in the book Richistan, recently analyzed the new Forbes list of the 400 richest Americans for The Wall Street Journal and found a “hardening of the plutocracy” and scant mobility. Only 16 of the 400 were newcomers — as opposed to an average of 40 to 50 in recent years — and they tended to be in industries like coal, natural gas, chemicals and casinos rather than forward-looking businesses involving the Green Economy, tech or biotechnology. This is “not exactly the formula for America’s vaunted entrepreneurial wealth machine,” Frank wrote.

Those in the higher reaches aren’t investing in creating new jobs even now, when the full Bush tax cuts remain in effect, so why would extending them change that equation? American companies seem intent on sitting on trillions in cash until the economy reboots. Meanwhile, the nonpartisan Congressional Budget Office ranks the extension of any Bush tax cuts, let alone those to the wealthiest Americans, as the least effective of 11 possible policy options for increasing employment.

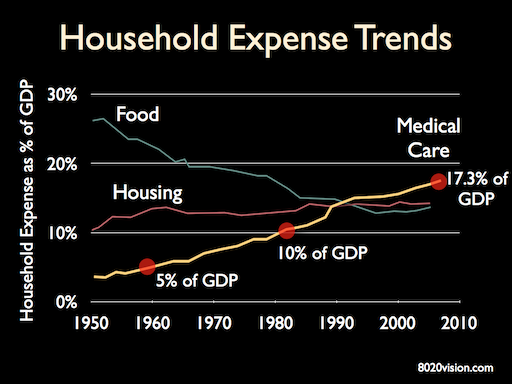

The middle class is experiencing the twin stress of falling income and increasing expenses. The most significant household expense is healthcare.

Healthcare costs represent a stunning 17% of GDP. Politicians that cut taxes without a plan for how to cover the costs of Medicare are dooming the middle class to a future of just working to pay for out of control medical costs.

With the Income Inequality Gap growing, perhaps we can understand why, during the 2010 midterm election, only 40 percent of voters approved of an extension of all Bush tax cuts.

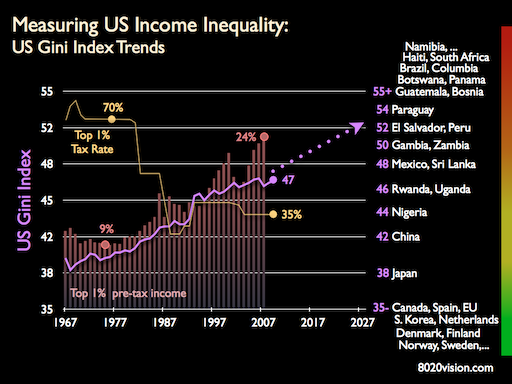

Measuring Income Inequality: The Gini Index

No society can sustain itself without a healthy middle class. No healthy society ignores it’s poor. As income inequality increases, social stability decreases.

Economists, the US Department of Labor, and analysts at the CIA, track Income Inequality using a metric known as the Gini Index (also known as the Gini Coefficient).

It is one of the essential metrics in the Political Instability Index, which is used to assess the level of threat posed to governments by social unrest. Zimbabwe, Chad and Congo rank most unstable, with Canada, Denmark, and Norway ranking most stable. Notably, the US, once the standard-setter of a stable democracy and middle class, has quickly fallen to an underwhelming rank 110 out of 165 countries.

The Gini Index is proportional to the Income Inequality of a nation. A Gini Index value of 0 indicates equal income for all earners. A Gini Index of 100 means that one person had all the income and nobody else had any.

A lower Gini Index indicates more equitable distribution of wealth in a society, while higher Gini Coefficients mean that wealth is concentrated in the hands of fewer people. Societies with high Gini Index tend to be unstable.

The chart below shows the historic trend of the Gini Index for the US, with tax rate and pre-tax income data for the top 1% of US earners in the background. On the right are various countries, with their associated Gini Index. Developed nations that take care of their own tend to have Gini indexes in the twenties and 30s. The US Gini Index is on track to breach 50 by the end of the decade, putting the US in the dubious country club of third world dictatorships and failing nations.

If you are a business leader, ask yourself, “Do I want to be living and building a business in world like that?” If the answer is NO, think about what public policy you are supporting through your contributions to politicians, associations and the Chamber of Commerce. Are the politicians you are supporting interested in a healthy middle class?

Business paid billions of dollars to politicians in the 2010 election. Paraphrasing W. W. Jacobs in his classic cautionary tale, The Monkey’s Paw, “Be careful what you wish for, you might get it.”

Recommended Reading

Winner-Take-All Politics by Jacob S. Hacker and Paul Pierson

Richistan by Robert Frank

The Spirit Level by Richard Wilkinson and Kate Pickett

The Monkey’s Paw By W.W. Jacobs

The Tyranny of Dead Ideas by Matt Miller

Rethinking the Measure of Growth by Jay Kimball

Nobel Laureate Joseph Stiglitz on Sustainability and Growth by Jay Kimball

The Bush Tax Cuts and the Economy by The Congressional Research Service

Kris Thomas says:

Oh some people… Sure it would be nice for those making less to pay nothing to live in this country while those that are well off pay our way through. But that is not right. You cannot just rely on others to take care of you. Learn to work hard and support yourself.

Jay Kimball says:

Hi Kris,

When you say “Sure it would be nice for those making less to pay nothing to live in this country”, that is not what is being suggested. What do you think about the observation that the top 1% have income at highs not seen since just before the depression, and tax rates that are at all time lows?

It sounds like you think the concentration of wealth at the top, and the growing income gap is not a concern.

How do you see these trends playing out?

What are your thoughts on how public policy should address the growing gap?

jaykimball says:

Warren Buffett on the top 1% tax cute. In short – NO. Makes no sense. Trickle down economics doesn’t work…http://www.huffingtonpost.com/2010/11/21/warren-buffett-paying-more-taxes_n_786516.html

Rachel_forshee says:

Thank you for your insightful post! I hope more people read this. You’ve really put the research into this and it show. Keep it up!

jaykimball says:

Warren Buffett writes a letter to Uncle Sam, thanking the government for doing a pretty good job handling the economy.

http://www.nytimes.com/2010/11/17/opinion/17buffett.html

jaykimball says:

Hi Kris,

When you say “Sure it would be nice for those making less to pay nothing to live in this country”, that is not what is being suggested. What do you think about the observation that the top 1% have income at highs not seen since just before the depression, and tax rates that are at all time lows?

It sounds like you think the concentration of wealth at the top, and the growing income gap is not a concern.

How do you see these trends playing out?

What are your thoughts on how public policy should address the growing gap?

jaykimball says:

Barry Ritholtz has a good article on the not extending the Bush Tax Cuts. Seehttp://www.ritholtz.com/blog/2010/08/a-closer-look-at-the-bush-tax-cuts/ I especially like the graphics: The Bush Tax Cuts: Born of Black Ink, Now Mired in Redhttp://www.ritholtz.com/blog/wp-content/uploads/2010/08/Bush-tax-cuts-BW.pngAverage Cuts by Income Level, for Republican and Democratic Planshttp://www.ritholtz.com/blog/wp-content/uploads/2010/08/GR2010081106717.gif

jaykimball says:

The nonpartisan Congressional Research Service (CRS) prepared a report for Congress on the impact of the Bush Tax Cuts on the economy.

The report details the various options of keeping SOME, ALL or NONE of the cuts.

The report is here:

http://www.scribd.com/doc/40488953/Bush-tax-Cuts-crs-10-27

Rita says:

Jay, I doubt if you’ll hear back from Kris. I have never gotten a straight answer when I’ve brought this up to conservatives. I think they just ignore the numbers.

Rkucklick says:

It seems that a big ball has started rolling and it is going to be hard to stop it

My impression is that a separation of the citizen and his government has been deliberately fostered. In that vacuum moneyed interests have lustily stepped in.

Coupled with that is the destruction of responsible journalism.

Well researched article, thank you.

Robin

jaykimball says:

Thanks Robin.

Regarding your comment on the “destruction of responsible journalism,” there was a good article at the Atlantic today on Wikileaks. Mainstream journalists are failing to keep the public informed. Though we enjoy a theoretical “freedom of the press.” the transition to “enetertainment news” leaves a void in true investigative reporting. The founder of Wikileaks, Julian Assange, criticizes the evident failures of the mainstream press, but insists that Wikileaks should facilitate traditional reporting and analysis. “We’re the step before the first person (investigates)” Assange said. Here’s a link to the article:

http://www.theatlantic.com/international/print/2010/12/the-shameful-attacks-on-julian-assange/67440/

Hoboboxerjoe says:

Brilliant!

jaykimball says:

Thanks Rachel! It is the #1 post on our blog. So a lot of people have read it.

Thanks for your support and good words.

Don mervis says:

Where is the middle class? I only see the working poor, the rich, and the poor. Your progressive mindset is based on flowed economics. You need to recalculate!

jaykimball says:

Don,

What would you like recalculated?

Jimafree says:

Wealth is created through widespread acquisition of knowledge that makes man more productive. Can you graph engineering degrees earned over the last 100 years as a percentage of the population? IMF and World Bank are proclaiming that the only way to fix the economy is to reduce support for the individual (education, social security and healthcare). Adam Smith is spinning in his grave.

Rick Dobbs says:

That is what faux news is trying to do. Now that people are feeling the squeeze of tough economic times, they need someone to blame. So they tell you to blame the poor, lazy, blacks, hispanics, terrorists–same old fox news fear mongering(wiki disinformation propaganda). Never mind the fact we our more productive,work more hours, and work later into life then ever before. For some life just looks better with a blindfold on. And the world is so much simpler when Glenn Beck teaches you trickle down economic 101.

Americans rely on themselves more then any industrialized nation on earth, and we live in a shit hole for adopting a reckless and selfish right wing ideology of cutting 9/11 first responder healthcare , defending the rich, shifting the tax burden onto the the middle class. Clearly, more of the same isn’t going to work.

Just remember there is no wealth without society, therefore the greater wealth you have the more of a DEBT you owe to the society supporting your fortunes.

jaykimball says:

As news shifts from investigation to entertainment, the quality of the information, insight, dialog and understand degrades. As we say in the data analysis business “Garbage in, garbage out.”

Especially unfortunate at this time, when global challenges are accelerating, and we should all be pulling together.

Perhaps you saw this study just released this past week, that found that Fox News viewers are much more likely to believe false information, and are the most misinformed.

http://www.worldpublicopinion.org/pipa/pdf/dec10/Misinformation_Dec10_rpt.pdf

In addition, leaks the past two weeks from within the Fox News bureau, show that they are purposefully spinning their reporting on healthcare reform and climate change to downplay the issues.

Here’s news on the Fox leaks:

Slanting healthcare reporting

http://mediamatters.org/blog/201012090003

Slanting climate change reporting

http://mediamatters.org/blog/201012150004

jaykimball says:

NY Times has a good article on income inequality, it explores, in a capitalist society, how much inequality is necessary?

“How Superstars’ Pay Stifles Everyone Else”

http://www.nytimes.com/2010/12/26/business/26excerpt.html?_r=1&emc=eta1

dkelly1349 says:

I started reading “All the Devils are Here: the Hidden History of the Financial Crisis.” Good book even with all the economics lexicon that is difficult to understand. In 1975 I read “Global Reach: the Power of the Multinational Corporations,” which predicted much of what has come to transpire.

Angiedtao says:

I read this article in “The Atlantic” about those in the upper 1%, and they simply don’t care any more about those of us in the lower 99% than we do about ants in an ant hill we might have in our backyard. This is a fact that that we must understand before any meaningful change in our tax laws can be made to even begin to rectify this yawning divide between them and the rest of us. I’m not even sure that it is possible to stop it at this late juncture. Until we thoroughly understand just how badly we have been robbed and elect people who aren’t part of ‘their’ crowd or beholden to them, nothing is going to change in American. Until then, their propaganda machine will continue to have us fighting each other over their leavings with the notion of ‘spreading the wealth’ aimed at liberals from conservatives who don’t understand that it isn’t the lower 99% whose wealth needs ‘spreading’.

The Rise of The New Global Elite

http://www.theatlantic.com/magazine/archive/2011/01/the-rise-of-the-new-global-elite/8343/7/

jaykimball says:

For a good example of how income inequality is an important contributor to social unrest, see this related post about revolution in Egypt:

http://8020vision.com/2011/02/05/what-feeds-a-revolution/

Mcoley11 says:

Thanks Jay for your helpful info.

Mcoley11 says:

Thanks Jay for your helpful info.

jaykimball says:

Here’s an excellent discussion of income, taxes, wealth and power in the US.

http://sociology.ucsc.edu/whorulesamerica/power/wealth.html

The discussion around Table 4 is fascinating. Here’s a quote:

“A remarkable study (Norton & Ariely, 2010) reveals that Americans have no idea that the wealth distribution (defined for them in terms of “net worth”) is as concentrated as it is. When shown three pie charts representing possible wealth distributions, 90% or more of the 5,522 respondents — whatever their gender, age, income level, or party affiliation — thought that the American wealth distribution most resembled one in which the top 20% has about 60% of the wealth. In fact, of course, the top 20% control about 85% of the wealth (refer back to Table 1 and Figure 1 in this document for a more detailed breakdown of the numbers).

Even more striking, they did not come close on the amount of wealth held by the bottom 40% of the population. It’s a number I haven’t even mentioned so far, and it’s shocking: the lowest two quintiles hold just 0.3% of the wealth in the United States. Most people in the survey guessed the figure to be between 8% and 10%, and two dozen academic economists got it wrong too, by guessing about 2% — seven times too high. Those surveyed did have it about right for what the 20% in the middle have; it’s at the top and the bottom that they don’t have any idea of what’s going on.”

Anonymous says:

Check out “The Spirit Level” by Wilkinson & Pickett, an epidemiological study of how income inqequality leads to poor physical health, social dysfunction and general unhappiness.

jaykimball says:

Thanks Jake. In fact, The Spirit Level is listed in our Recommended Reading section. For a direct link to Amazon and more info on The SPirit Level, see:

Charlieopera says:

And here’s the killer … most going to the election polls will continue to vote for either of the two parties that have represented the 1-2%’s so well over the time span above. Time for a third party, maybe? You think?

jaykimball says:

Good article on GE paying no tax on $14.2 billion in profit. Though the US has one of the highest corporate tax rates in the world, there are numerous loopholes, and offshore tax avoidance strategies businesses use to pay far less tax. For more, see:

http://www.nytimes.com/2011/03/25/business/economy/25tax.html?_r=2&hp=&pagewanted=all

Here’s an excerpt:

“The shelters are so crucial to G.E.’s bottom line that when Congress threatened to let the most lucrative one expire in 2008, the company came out in full force. G.E. officials worked with dozens of financial companies to send letters to Congress and hired a bevy of outside lobbyists.

The head of its tax team, Mr. Samuels, met with Representative Charles B. Rangel, then chairman of the Ways and Means Committee, which would decide the fate of the tax break. As he sat with the committee’s staff members outside Mr. Rangel’s office, Mr. Samuels dropped to his knee and pretended to beg for the provision to be extended — a flourish made in jest, he said through a spokeswoman.

That day, Mr. Rangel reversed his opposition to the tax break, according to other Democrats on the committee.

The following month, Mr. Rangel and Mr. Immelt stood together at St. Nicholas Park in Harlem as G.E. announced that its foundation had awarded $30 million to New York City schools, including $11 million to benefit various schools in Mr. Rangel’s district. Joel I. Klein, then the schools chancellor, and Mayor Michael R. Bloomberg, who presided, said it was the largest gift ever to the city’s schools.

G.E. officials say the donation was granted solely on the merit of the project. “The foundation goes to great lengths to ensure grant decisions are not influenced by company government relations or lobbying priorities,” Ms. Eisele said.

Mr. Rangel, who was censured by Congress last year for soliciting donations from corporations and executives with business before his committee, said this month that the donation was unrelated to his official actions.”

jaykimball says:

Nobel Laureate Joseph Stiglitz has an outstanding cogent article at Vanity Fair this week. Read every word. See:

http://www.vanityfair.com/society/features/2011/05/top-one-percent-201105?currentPage=2

Here’s an excerpt:

“Alexis de Tocqueville once described what he saw as a chief part of the peculiar genius of American society—something he called “self-interest properly understood.” The last two words were the key. Everyone possesses self-interest in a narrow sense: I want what’s good for me right now! Self-interest “properly understood” is different. It means appreciating that paying attention to everyone else’s self-interest—in other words, the common welfare—is in fact a precondition for one’s own ultimate well-being. Tocqueville was not suggesting that there was anything noble or idealistic about this outlook—in fact, he was suggesting the opposite. It was a mark of American pragmatism. Those canny Americans understood a basic fact: looking out for the other guy isn’t just good for the soul—it’s good for business.”

jaykimball says:

ThinkProgress has crunched some IRS data on the top 400 earners in the US, looking at income and tax rate trends. Bottom line: In 12 Years, Income For Richest 400 Americans Quadruples, Tax Rate Nearly Halved

See:

http://thinkprogress.org/2011/04/18/tax-disparity-chart/

jaykimball says:

The Financial Times of London published a pertinent article today on Income Inequality in China. See:

http://www.ft.com/cms/s/0/2eecc5ee-6b47-11e0-9be1-00144feab49a.html#axzz1K8JfrJB9

China is concerned about it getting out of hand. The article says:

“China is to lift the exemption threshold for personal income tax payments in an effort to redistribute the spoils of rapid growth and reduce a widening wealth gap. The change, which is likely to come in the second half of the year, is one of several policy initiatives intended to alleviate poverty and reduce growing income disparity.”

In related news, here in the US – Polls out in the US this week show that over two-thirds of Americans think that the Bush tax cuts should be ended, allowing the tax rate to return to higher levels for the top 1% of earners. See:

http://www.mcclatchydc.com/2011/04/18/112386/poll-best-way-to-fight-deficits.html

“WASHINGTON — Alarmed by rising national debt and increasingly downbeat about their country’s course, Americans are clear about how they want to attack the government’s runway budget deficits: raise taxes on the wealthy and keep hands off of Medicare and Medicaid.”

jaykimball says:

Here’s an excellent editorial on taxing what hurts us, as a way to reduce the deficit and improve the quality of life. See:

http://www.robert-h-frank.com/PDFs/EV.02.20.11.pdf

Andy says:

Great article. Re. “If you are a business leader, ask yourself, “Do I want to be living and building a business in world like that?”” I think the answer is that they don’t care. Some of the elite believe that, well they climbed to the top, so anyone else can too. Others with multiple homes in more stable countries are quite aware of what is happening but can relocate globally as necessary.

KarenAnderson says:

I really appreciate the facts and graphs as presented………the politicians need to present something similar to the American voters so they can better understand what the arguments are about…….excellent job!

jaykimball says:

Thanks Karen. Yes, it is remarkable how few tools politicians use to communicate important complex information. Rhetoric and stone throwing doesn’t advance understanding and moves us away from consensus.

jaykimball says:

Here’s Jeffrey Sachs talking about Occupy Wall Street, and how it relates to revolutions around the world. Sachs is smart, articulate, connects the dots. The reports are asking good questions. It’s about time.

Anonymous says:

For a fairly comprehensive analysis of the causes and remedies: http://99percentmanifesto.blogspot.com/2011/10/manifesto.html

jaykimball says:

Income inequality too hot for TED talks…

http://www.nationaljournal.com/features/restoration-calls/too-hot-for-ted-income-inequality-20120516