Keywords: Google, California Proposition 23, Vinod Khosla, William Wiehl, cleantech, A.B. 32

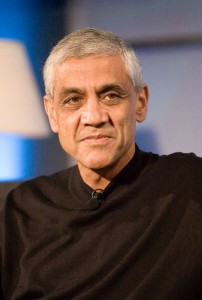

Google convened an event at their Silicon Valley campus to discuss the implications of California’s Proposition 23, an attempt to rollback the state’s ambitious climate legislation (A.B. 32). In an article at Greentech Media, panelists, including venture capitalist Vinod Khosla, sounded upbeat on contributions California cleantech ventures will make toward solving US energy and climate challenges.

Highlights from Google’s Implications for California Proposition 23 Event

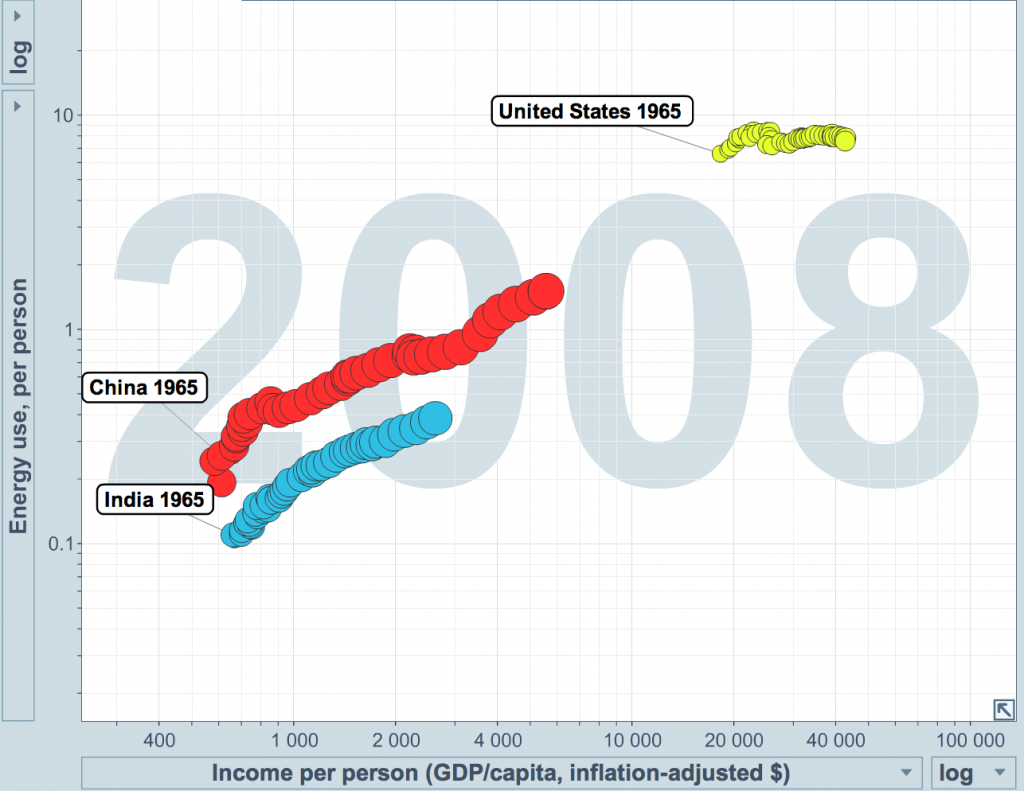

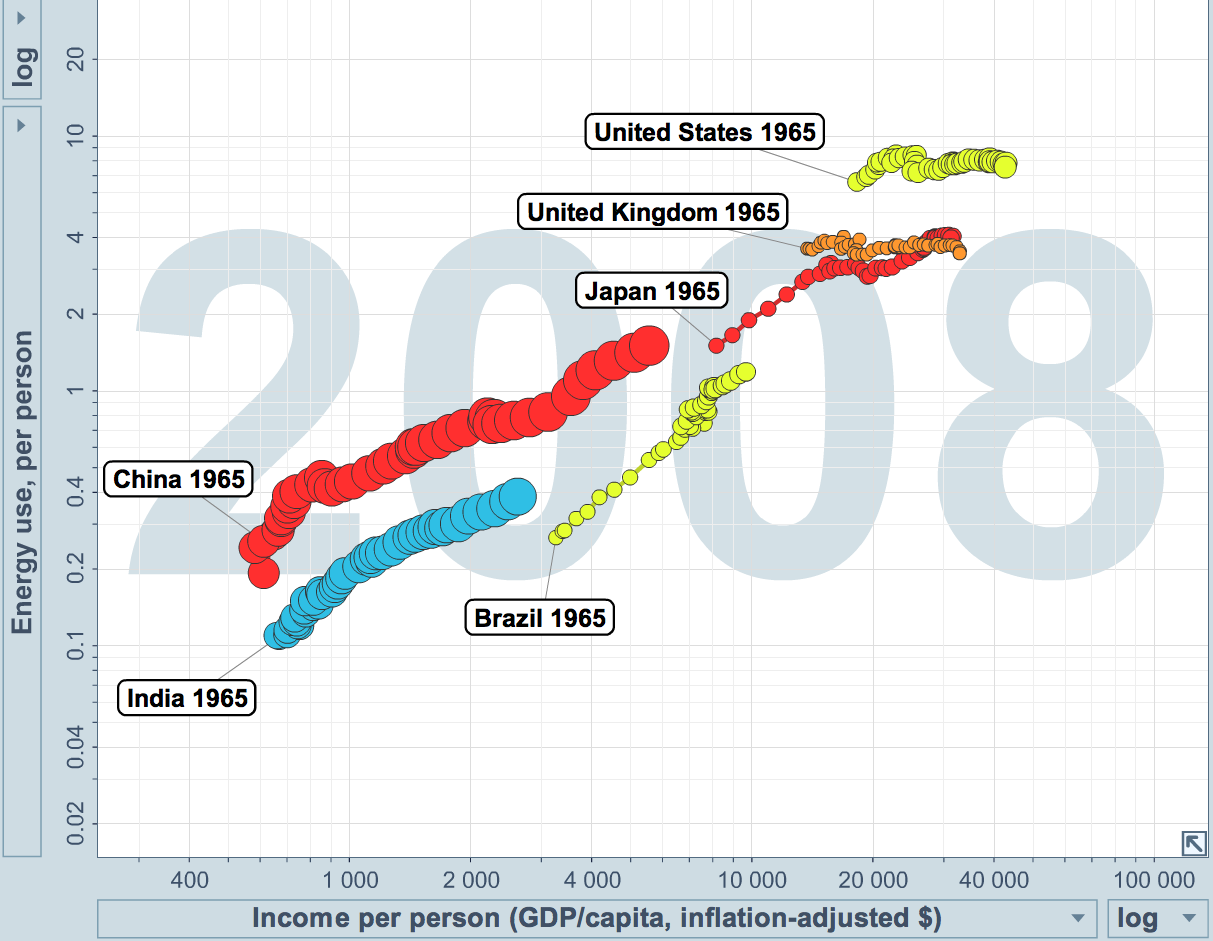

- Khosla stole the show with his outlook for the clean-tech innovation and energy use. “In 10 to 15 years, we will be shutting down (power) plants” because of an excess of electricity in this country, Khosla said. There is an “infinite” opportunity for technological innovation.

- Khosla’s firm is backing companies that hope to cut energy use in lighting and data center server racks by 80 percent.

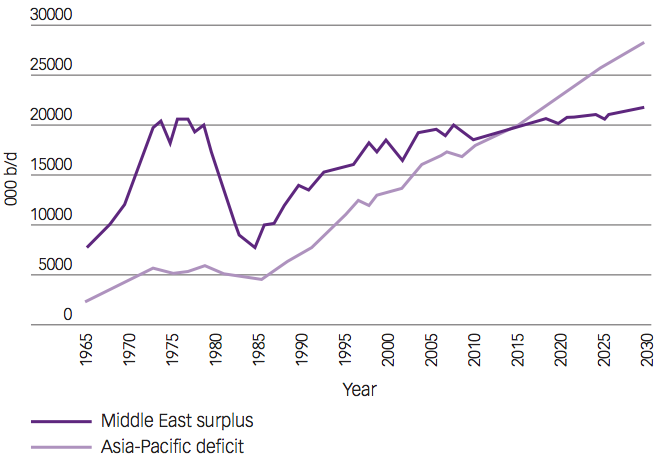

- Regarding China’s serious investment in cleantech, Khosla said “I won’t say China is winning the cleantech race,” he says. “But they are clearly paying a lot more attention to the race.”

- Asked if there was an advantage to creating companies in Silicon Valley rather than China, Khosla was emphatic. “No question about it. The people are here. The markets are here.”

- According to Khosla, nuclear power no longer has an advantage over renewables. There hasn’t been a nuclear plant build in recent years that can beat $7,000 a kilowatt. That makes wind and solar (in some parts of the world) competitive, he says.

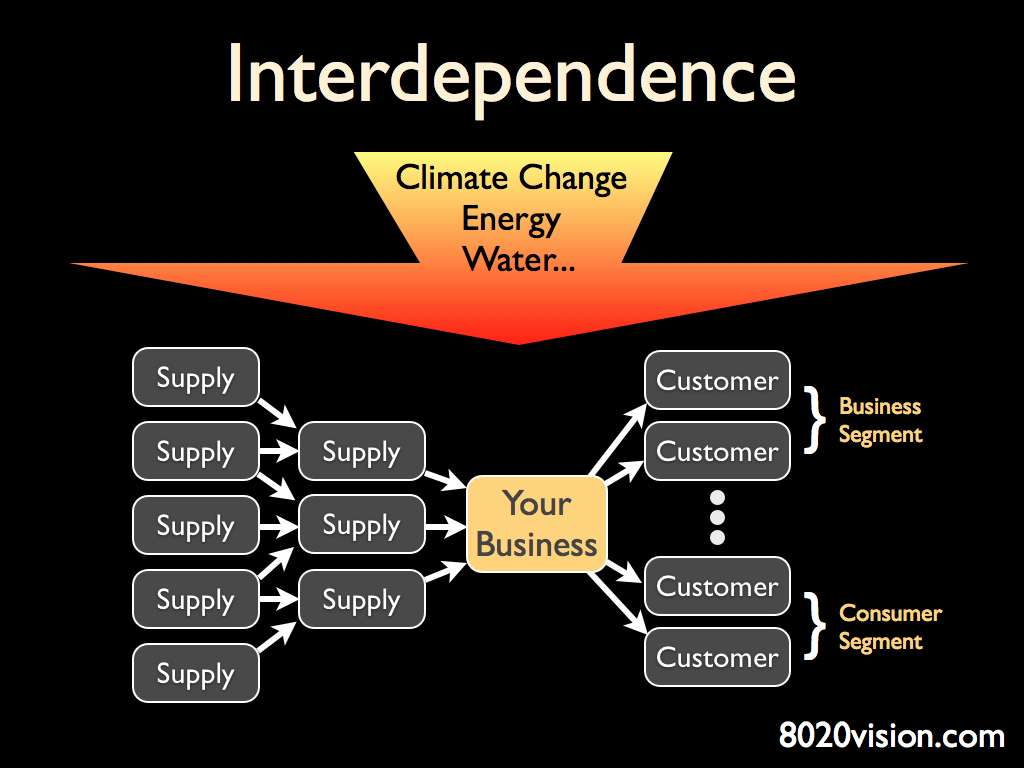

- Proposition 23 is a threat because it will kill the clean-energy markets that California’s A.B. 32 created. Both Khosla and Google Green Energy Czar William Wiehl concur on this point. Proposition 23, which will go to the ballot in November, would suspend A.B. 32 [see note below for background on A.B 32] until the state’s unemployment rate drops to 5.5 percent or less for four consecutive quarters. Texas oil companies Valero and Tesoro back the measure. A.B. 32 sets reporting guidelines for polluters, establishes a statewide limit for carbon, and guides emissions back to 1990 levels by 2020.

- A.B. 32 has helped create 500,000 cleantech jobs in California, Wiehl says.

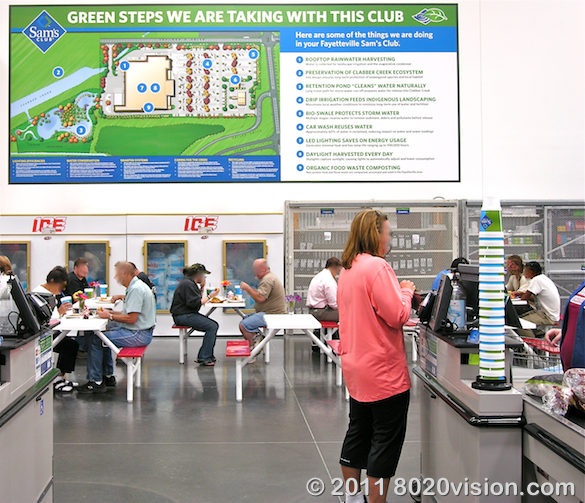

- Google, adds Wiehl, has made strides with energy efficiency. The company builds its own data centers and servers. As a result, data center energy use is half of what it would be if the company followed industry-standard best practices, he said.

- As to the next Google — “There is no doubt in my mind we will see 10 of these” in cleantech, says Khosla. “Today, California has the pole position to win that race.”

Note:

California’s major initiatives for reducing climate change or greenhouse gas (GHG) emissions are outlined in Assembly Bill 32 (signed into law 2006), 2005 Executive Order and a 2004 ARB regulation to reduce passenger car GHG emissions. These efforts aim at reducing GHG emissions to 1990 levels by 2020 – a reduction of approximately 30 percent, and then an 80 percent reduction below 1990 levels by 2050. The main strategies for making these reductions are outlined in the Scoping Plan. Also provided here are links to state agencies and other groups working on climate issues which are being coordinated by the state’s Climate Action Team.

More on the California’s Prop 23 initiative here: