Keywords: Feebate, Art Rosenfeld, RMI, reducing automobile CO2 emissions, reducing oil addiction

Feebates offer a compelling approach to curbing automobile fuel consumption and CO2 emissions. The concept was pioneered in the 1970s by Jonathan Koomey and Art Rosenfeld (Lawrence Berkeley National Laboratory) and is finding renewed interest around the world.

Feebates are market-based policies for encouraging emissions reductions from new passenger vehicles by levying fees on relatively high-emitting vehicles, and using those collected fees to provide rebates to lower-emitting vehicles.

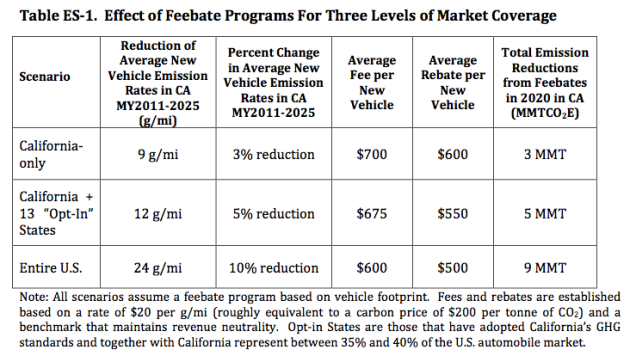

California is considering adopting a Feebate program. The UC Davis Institute of Transportation Studies recently published their analysis of a Feebate program – Potential Design, Implementation, and Benefits of a Feebate Program for New Passenger Vehicles in California. The report provides a detailed overview and analysis of Feebates and reviews Feebate programs already underway in other countries.

Rocky Mountain Institute has a good review of the Feebate approach to reducing oil consumption.

Highlights of RMI’s report Feebates: A Key to Breaking U.S. Oil Addiction

- The scale of U.S. oil consumption (nearly 19 million barrels per day) combined with its virtual monopoly of transportation energy (97 percent oil-based), creates strategic weakness, economic insecurity, widespread health hazards, and environmental degradation.

- Feebate is an innovative policy that greatly speeds the development and deployment of efficient vehicles.

- The California Legislature actually approved a similar “Drive+” law by an astonishing seven-to-one margin in 1980, but Governor George Deukmejian pocket-vetoed it after a mixed initial reaction from automakers, and it’s been bottled up ever since.

The basic idea of a feebate is simple. Buyers of inefficient vehicles are levied a surcharge (the “fee”), while buyers of efficient vehicles are awarded a rebate (the “bate”). By affecting the purchase cost up front, feebates speed the production and adoption of more efficient vehicles, saving oil, insecurity, cost, and carbon.

Though efficient vehicles’ reduced operating costs make them a good buy over the years, consumers’ implicit real discount rates, up to 60-plus percent per year (and nearly infinite for low-income car-buyers), make miles per gallon a relatively weak economic signal: long-term fuel savings are so heavily discounted that buyers, in effect, count just the first year or two—as minor an economic choice as whether to buy floor mats.

In contrast, feebates capture the life-cycle value of efficiency (or the cost of inefficiency) and reflect it in the sticker price. By increasing the price spread between less and more efficient vehicles, feebates bridge the gap between consumers’ and society’s perceptions of the time value of money. This corrects the biggest single obstacle to making and buying efficient vehicles.

Feebates can shift purchasing patterns in the short run and spur automakers’ innovation in the medium and long run. But to do both, a feebate program, like any well intentioned policy, must be properly designed and implemented. As RMI Principal Nathan Glasgow notes, “With feebates, the devil is really in the details.”

Feebate Forum

In 2007, RMI organized and hosted the first Feebate Forum, pulling together 27 experts from the auto and insurance industries, NGOs, academia, and government to discuss feebate design and implementation schemes. Through open dialogue, the group developed a set of design recommendations, barriers, and next steps for feebates.The participants agreed on the following design goals:

1. Metrics should be based on fuel efficiency or greenhouse gas emissions, and all types of transportation energy can be included—not just diverse fuels but also electricity.

2. The size of the fee or rebate shouldn’t depend on vehicle size. The feebate should reward buyers for choosing a more efficient model of the size they want, not for shifting size. A size-class-based feebate preserves the competitive position of each automaker regardless of its offerings, debunks the myth that consumers must choose between size and efficiency, and doesn’t restrict freedom of choice. Buyers can get the size they want; the efficiency of their choice within that size class determines whether they pay a fee or get a rebate, and how much.

3. Feebates should be implemented at the manufacturer level, so automakers, rather than a government agency, should pay the fees and collect the rebates. This lets manufacturers monitor results and adjust their vehicle mix accordingly, and it avoids any need for taxpayers to foot the bill for any costs. However, a good feebate program should be revenue-neutral, with “fees” paying for “bates” plus administrative costs—a potentially attractive feature. And since the “fees” are entirely avoidable by choice, they’re not a tax.

4. The “pivot point” between fees and rebates should be adjusted annually, so the program is trued up to stay revenue-neutral, and automakers have a predictable and continuous incentive to improve the efficiency of their offerings, spurring innovation.

5. Feebates should be designed for complete compatibility with efficiency or carbon-emissions standards, so automakers aren’t whipsawed between incompatible incentives or requirements. In practice, feebates may drive efficiency improvements much larger and faster than standards require, making the standards unimportant except to prevent recidivism.

France introduced the largest feebate program to date

- Averaging 133 grams of carbon dioxide per kilometer for the 2009 new light-vehicle fleet, France’s vehicles now have the lowest carbon emissions in the European Union.

- By comparison, the UK’s 2009 new vehicles emitted, and the EU average is, 146. Between 1995 and 2007 (when the French feebate was introduced at year-end), the emissions rate of new vehicles sold in France was falling at an average rate of 2.25 grams of carbon dioxide per kilometer per year. During the first two years of the feebate program, the annual emissions decrease more than tripled to 8 grams per kilometer. Overall, the efficient bonus vehicles’ market share nearly doubled, from 30 to 56 percent, while the inefficient malus vehicles’ share fell threefold, from 24 to 8 percent.

The French program was not size-neutral as RMI recommends for the U.S., and the data show it shifted new-car buyers toward smaller vehicles. The market share of the smallest (economy) cars grew from 44 percent in 2007 to 57 percent in 2009, much as we’d expect for such a fleetwide feebate structure: smaller vehicles tend to have higher efficiency and lower carbon emissions, so unless unusually inefficient, they’ll earn a rebate that’s attractive to many buyers. For the U.S., RMI recommends a size-neutral feebate design to shift the entire market toward lighter, more aerodynamic, and advanced-powertrain vehicles, not just smaller ones.

California is currently considering the introduction of a statewide feebate bill

- A state program would probably do more to shift the in-state vehicle sales mix than to spur innovative design, since even a market as big as California represents only a fraction of the U.S. auto market. Nonetheless, RMI is following this program closely.

- In 2008, California’s aggressiveness on fuel efficiency spurred higher national CAFE standards, and a number of other states follow California’s lead on Clean Air Act and related policies. States and regions can make fine laboratories for refining policy innovations that later guide uniform national policies.